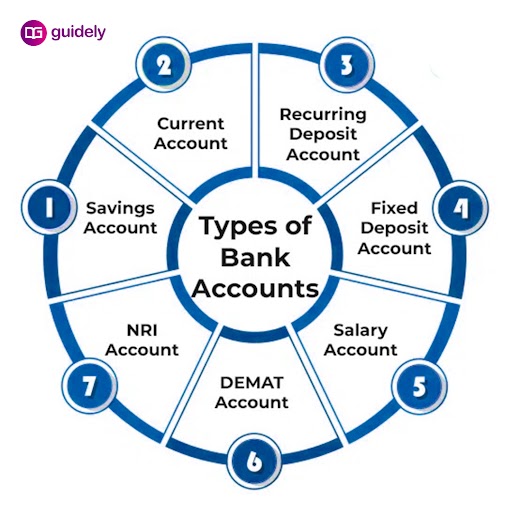

Types Of Accounts In A Bank In India: Details With Features And Benefits

Oct 18 2025

Types Of Accounts In A Bank: The types of accounts in a bank are the information that every individual needs to know. The different types of bank accounts and their purpose should be known for effective usage. Private banks, public sector banks or nationalized banks, foreign banks, and cooperative banks are the four types of banks that operate in India. Citizens in India may open a bank account with any of these four types of institutions. You must be aware of the types of bank accounts each of the four different types of banks offers to know how to choose one that meets your needs. Bank accounts aid in protecting your financial assets. By enabling you to get interest on your deposits, they also assist you in compounding your savings or investments. Aspirants in search of types of bank accounts India, 4 types of bank accounts explained, what are the types of bank accounts, what are all the different types of bank accounts, what are the different types of a bank, types of bank accounts in India, types of bank accounts PDF, types of bank accounts chart, etc., can refer to the details provided here in this article.

What Are The Types Of Bank Accounts?

The types of bank accounts in India are Savings account, current account, recurring deposit account, NRI Account, Fixed deposit account, and demat account. The different types of bank accounts are mentioned below.

1. Savings Account

Savings accounts, as the name implies, can be opened jointly by two persons or by an individual with the intention of saving money. Opening a savings account with a bank has several advantages, the primary one being that the bank will pay you interest for doing so. Some of the important features of the savings bank account are mentioned here.

- The amount of money that can be deposited into this account is unlimited; however, the amount of money that can be taken out of the account is limited.

- An account holder's annual interest rate can range from 4% to 6%.

- For this kind of account, there is no minimum balance required to be kept.

- If desired, the holders of savings accounts may obtain an ATM, debit card, or Rupay card.

- There are two types of savings bank accounts: Basic Savings Bank Deposit Accounts (BSBDA) and Basic Savings Bank Deposit Accounts Small Scheme (BSBDS).

- The majority of people who can open a savings bank account are working professionals, retirees, and students.

2. Current Account

The majority of current accounts are company accounts used for regular money transfers between other bank accounts. The transactions made by companies and company owners for routine business operations are most appropriate for these accounts.

- There is no limit to the quantity of money that can be deposited into a current account.

- Furthermore, existing accounts are not subject to transaction restrictions. concord.

- A current account has a greater minimum balance requirement than a savings account.

- There is currently no interest paid to current account holders. a benefit.

- The overdraft facility allows users to withdraw more money from these accounts than is actually in the account.

3. Recurring Deposit Account

A recurring deposit account, often known as an RD account, requires the account user to deposit a set sum each month until the account reaches its predetermined maturity date.

- Any person or organization may open a recurring deposit account on their own or jointly with another.

- Periodic or monthly payments that must be made in addition might start as little as Rs. 50 or can differ from bank to bank.

- An RD account may be opened for a period of time between 6 and 120 months.

- Depending on the bank you choose to open an account with, the interest rate varies.

- For RC accounts, a nomination facility is also accessible.

- For this kind of bank account, a passbook is provided.

- Premature withdrawal of the funds is allowed as long as a certain amount is subtracted as a penalty.

4. NRI Account

The option of an NRI account is provided to satisfy the bank needs of a Non-Resident Indian or a Person of India Origin.

Three categories have been added to the NRI Accounts:

- You would be able to transfer your international profits to India with ease if you have an NRO (Non-Resident Ordinary Rupees) Account. It can be opened as a savings, FD, RD, current, or current account. Both individuals and groups may open these accounts.

- NRE (Non-Resident External Rupees) Account - An Indian citizen's account must be changed into an NRE account when they relocate to work overseas.

- This account may be opened in conjunction with an FCNR (Foreign Currency Non-Resident) Account held by an Indian resident. To manage a foreign currency, this kind of account might be opened. It can only be withdrawn after the maturity time and can only take the form of a term deposit.

5. Fixed Deposit Account

Another sort of bank account that can be opened in any public or private sector bank is a fixed deposit account (FD).

- It is a one-time-only account with a single deposit and withdrawal. In this kind of account, the account user must deposit a set quantity of money over a predetermined period of time (as they see fit).

- It is not possible to withdraw the money from an FD account in installments; it can only be done all at once.

- Interest is paid by banks on fixed deposit accounts.

- The amount you deposit and the length of the FD are factors in the interest rate.

- The entire sum may be repaid before the FD's maturity date.

6. DEMAT Account

The DEMAT account is made up of shares and securities that can be stored electronically. Dematerialized Account is another name for the DEMAT account.

- In India, there are just two depository institutions that oversee this kind of bank account. National Securities Depository Limited and Central Depository Services Limited are included in this.

- This makes trading bonds and shares more convenient.

- aids in carrying out stress-free share transactions

- Opening a DEMAT account requires KYC, which lowers transaction costs

- Trades can be made from any location.

- Reduced paperwork can be used to transfer securities.

Importance of Bank Accounts

Here are some fantastic reasons to have a bank account to help manage the finances.

- Transactions can be made easily with bank accounts. If one has a bank account, they can readily withdraw money and make payments.

- Your hard-earned money is kept safe in a bank account, and even if the bank or union closes, you are guaranteed to get your money back.

- Bank accounts are less expensive because the majority of banks and financial organizations provide free or inexpensive services to account users.

- It is a simple technique to increase wealth. When you deposit money into a savings account, the majority of banks offer you a rate of interest. Your money will gradually increase thanks to the interest.

- It provides simple access to credit. Having a bank account is advantageous since banks give their customers the ability to obtain credit for personal loans, house loans, education loans, etc.

FAQs - Types Of Bank Accounts

Q. What are the different types of bank accounts?

The types of bank accounts in India are Savings Account, Current Account, recurring deposit Account, NRI Account, Fixed Deposit Account, and Demat Account.

Q. What is a demat account?

The DEMAT account is made up of shares and securities that can be stored electronically. Dematerialized Account is another name for the DEMAT account.

Q. What is the full form of the NRI Account?

The full form of the NRI Account is a Non-Resident Indian Account.

General Awareness Smart Analysis (Smart Quiz 2.0)

- Get Weekly 4 set Test

- Each Set consist of 50 Questions

- Compare your progress with Test 1 & 2 & Test 3 & 4

- Deep Analysis in topic wise questions

Super Plan

- All Banking PDF Course 2026, 2025, 2024

- All Banking Video Course

- All Banking Mock Test Series

- All Banking Bundle PDF Courses

- All Banking Ebooks

- All Banking Interview Courses Not Included

Premium PDF Course

- Bundle PDF Course 2025

- Premium PDF Course 2024

- Prime PDF Course 2023