Daily Current Affairs Quiz - 02nd & 03rd March 2025

Mar 03 2025

Dear Readers, Daily Current Affairs Questions Quiz for SBI, IBPS, RBI, RRB, SSC Exam 2025 of 02nd & 03rd March 2025. Daily GK quiz online for bank & competitive exam. Here we have given the Daily Current Affairs Quiz based on the previous days Daily Current Affairs updates. Candidates preparing for IBPS, SBI, RBI, RRB, SSC Exam 2025 & other competitive exams can make use of these Current Affairs Quiz.

1) What is the primary objective of the NPST and Hyperface partnership in India?

(a) To increase the number of credit cards issued in India

(b) To offer embedded credit lines through UPI for banks and credit issuers

(c) To replace traditional credit card usage with UPI payments

(d) To develop a new UPI payment application for small businesses

(e) To restrict credit access to high-income individuals

2) What technology does Bank of Baroda's pilot Loyalty/Cashback Programme leverage?

(a) Artificial Intelligence (AI)

(b) Blockchain technology

(c) Central Bank Digital Currency (CBDC)

(d) Unified Payments Interface (UPI)

(e) Biometric authentication

3) Who developed the Bond Central portal in collaboration with Market Infrastructure Institutions (MIIs)?

(a) Reserve Bank of India (RBI)

(b) Online Bond Platform Providers Association (OBPP Association)

(c) Ministry of Finance

(d) National Payments Corporation of India (NPCI)

(e) Association of Mutual Funds in India (AMFI)

4) Which two institutions signed the second Amendment and Restatement Agreement of the Bilateral Swap Arrangement (BSA)?

(a) Bank of Japan and World Bank

(b) Reserve Bank of India and International Monetary Fund

(c) Bank of Russia and Reserve Bank of India

(d) Reserve Bank of India and Asian Development Bank

(e) Bank of Japan and Reserve Bank of India

5) Which department of the RBI compiled the “Regulations at a Glance” handbook?

(a) Department of Supervision

(b) Monetary Policy Department

(c) Department of Regulation (DoR)

(d) Financial Inclusion and Development Department

(e) Department of Economic and Policy Research

6) What was the total penalty imposed by the Reserve Bank of India (RBI) on HSBC?

(a) ₹33.60 lakh

(b) ₹66.60 lakh

(c) ₹56.60 lakh

(d) ₹76.60 lakh

(e) ₹86.60 lakh

7) How does UPI Lite differ from regular UPI transactions?

(a) It allows users to link multiple bank accounts for a single transaction

(b) It enables direct withdrawals from bank accounts without authentication

(c) It requires users to preload a small balance for faster payments

(d) It supports only QR code-based payments

(e) It is exclusive to WhatsApp and cannot be used on other platforms

8) Recently, the Fintech startup,Rupee112 Launched India’s First Fully Automated WhatsApp Loan Disbursal. Which city is Rupee112 based in?

(a) Mumbai

(b) Bangalore

(c) Hyderabad

(d) Gurgaon

(e) Pune

9) How many total UPI transactions were recorded in the financial year 2023-24?

(a) 110 billion

(b) 120 billion

(c) 125 billion

(d) 131 billion

(e) 140 billion

10) How much was the dollar-rupee swap conducted by RBI less than a month before the $10 billion swap?

(a) $3 billion

(b) $5 billion

(c) $7 billion

(d) $8 billion

(e) $12 billion

11) Which crops are the primary focus of the 10,000th FPO launched in Khagaria, Bihar?

(a) Wheat, sugarcane, and pulses

(b) Maize, banana, and paddy

(c) Cotton, mustard, and tea

(d) Coffee, jute, and soybeans

(e) Spices, coconut, and groundnut

12) Recently, the Union government is considering a reduction in the share of central tax revenues allocated to states, lowering it from the current 41% to at least 40%. Who is the current chairperson of the Finance Commission of India?

(a) Raghuram Rajan

(b) Urjit Patel

(c) Arvind Panagariya

(d) N.K. Singh

(e) Montek Singh Ahluwalia

13) Who is the author of Diyaslai, the autobiography discussed in the IGNCA event?

(a) Amartya Sen

(b) Kailash Satyarthi

(c) Malala Yousafzai

(d) Raghuram Rajan

(e) Arundhati Roy

14) Under which fund has India provided approximately USD 1 million to Lao PDR?

(a) SAARC Development Fund

(b) India-UN Development Partnership Fund

(c) BRICS Economic Cooperation Fund

(d) ASEAN Infrastructure Fund

(e) World Bank Nutrition Fund

15) What is the Employees’ Provident Fund Organisation (EPFO) interest rate for the financial year 2024-25?

(a) 7.75%

(b) 8.00%

(c) 8.75%

(d) 8.50%

(e) 8.25%

16) What is the collective weightage of the Eight Core Industries in the Index of Industrial Production (IIP)?

(a) 30.15%

(b) 35.42%

(c) 51.28%

(d) 45.89%

(e) 40.27%

17) Recently, the India-European Union Meeting on Science & Technology Cooperation Held in New Delhi. Which European leader's visit coincided with the India-EU Science and Technology meeting?

(a) Emmanuel Macron

(b) Olaf Scholz

(c) Giorgia Meloni

(d) Ursula von der Leyen

(e) Charles Michel

18) Which country did Ron Draper represent in international cricket?

(a) Australia

(b) England

(c) South Africa

(d) New Zealand

(e) West Indies

19) When was World Seagrass Day observed annually?

(a) February 28

(b) March 1

(c) April 5

(d) June 8

(e) March 3

20) When were the World Hearing Day & World Wildlife Day observed?

(a) February 28

(b) March 1

(c) April 5

(d) June 8

(e) March 3

Answers :

1) Answer: B

Short Explanation:

NPST, an Indian fintech firm, has partnered with Hyperface to offer embedded credit lines through UPI for banks and credit issuers.

India has a significant gap in affordable credit access, with only 100 million credit cards compared to over 400 million UPI users.

Detailed Explanation:

NPST, an Indian fintech firm, has partnered with Hyperface to offer embedded credit lines through UPI for banks and credit issuers.

India has a significant gap in affordable credit access, with only 100 million credit cards compared to over 400 million UPI users.

The collaboration aims to provide seamless, digital-first credit solutions to enhance purchasing power and promote financial inclusion.

Consumers will have access to pre-approved credit lines at the point of sale and the ability to split payments into flexible installments.

Merchants will benefit from higher conversion rates, larger transaction values, and improved customer loyalty.

NPST will integrate its UPI switch technology with Hyperface’s Embedding Banking Platform to facilitate seamless transactions.

2) Answer: C

Short Explanation:

Bank of Baroda (BoB) has launched a pilot Loyalty/Cashback Programme for merchants, leveraging the programmability of the Central Bank Digital Currency (CBDC).

The initiative is in collaboration with a fintech company and is available through the ‘bob Merchant App’.

Detailed Explanation:

Bank of Baroda (BoB) has launched a pilot Loyalty/Cashback Programme for merchants, leveraging the programmability of the Central Bank Digital Currency (CBDC).

The initiative is in collaboration with a fintech company and is available through the ‘bob Merchant App’.

It enables small and medium merchants, such as local retail shops, grocery stores, and pharmacies, to independently create and run loyalty/cashback programmes.

Merchants do not need to invest in additional infrastructure or software to operate these reward programmes.

Merchants can configure their cashback offers, including the campaign period, cashback percentage, and expiry date.

3) Answer: B

Short Explanation:

Securities and Exchange Board of India (SEBI) has launched a centralized database portal for corporate bonds called Bond Central to provide a single, authentic source of information on corporate securities.

The portal has been developed by the Online Bond Platform Providers Association (OBPP Association) in collaboration with Market Infrastructure Institutions (MIIs), including stock exchanges and depositories.

Detailed Explanation:

Securities and Exchange Board of India (SEBI) has launched a centralized database portal for corporate bonds called Bond Central to provide a single, authentic source of information on corporate securities.

The portal has been developed by the Online Bond Platform Providers Association (OBPP Association) in collaboration with Market Infrastructure Institutions (MIIs), including stock exchanges and depositories.

Bond Central is a public information repository, accessible free of cost, aimed at enhancing transparency and informed decision-making for investors and market participants.

The OBPP Association, a not-for-profit entity, will operate the portal with support from MIIs.

Unified view of corporate bonds across exchanges and issuers.

Comparison tool for corporate bond prices with Government Securities (G-Secs) and other fixed-income indices.

Access to detailed risk assessments, corporate bond documents, and disclosures to help investors evaluate opportunities.

Standardised corporate bond data to reduce information asymmetry and build market trust.

4) Answer: E

Short Explanation:

The Bank of Japan, acting as agent for the Minister of Finance of Japan, and the Reserve Bank of India signed the second Amendment and Restatement Agreement of the Bilateral Swap Arrangement (BSA).

The BSA is a two-way arrangement where both authorities can swap their local currencies in exchange for the US Dollar.

Detailed Explanation:

The Bank of Japan, acting as agent for the Minister of Finance of Japan, and the Reserve Bank of India signed the second Amendment and Restatement Agreement of the Bilateral Swap Arrangement (BSA).

The BSA is a two-way arrangement where both authorities can swap their local currencies in exchange for the US Dollar.

The size of the BSA remains unchanged, that is, up to 75 billion US Dollars.

Japan and India believe that the BSA, which aims to strengthen and complement other financial safety nets, will further deepen financial cooperation between the two countries and contribute to regional and global financial stability.

5) Answer: C

Short Explanation:

The Reserve Bank of India has released the “Regulations at a Glance” handbook, compiled by the Department of Regulation (DoR), to provide a broad overview of the regulatory landscape across various activities and entities.

Organized into 6 chapters, it presents a tabular summary of major regulations issued by the DoR.

Detailed Explanation:

The Reserve Bank of India has released the “Regulations at a Glance” handbook, compiled by the Department of Regulation (DoR), to provide a broad overview of the regulatory landscape across various activities and entities.

Organized into 6 chapters, it presents a tabular summary of major regulations issued by the DoR.

- Licensing of New Institutions

Urban Cooperative Banks (UCBs):

Required paid-up capital/net worth: ₹12.5 lakh – ₹4 crore (depending on center and population size).

RBI stopped accepting new applications for UCB licenses since 2004.

Rural Cooperative Banks (StCBs & CCBs):

Declared as StCB/CCB by the State Government.

RBI grants licenses based on NABARD's recommendations and internal assessment.

Promoter Conditions:

Focus on educational background, financial standing, governance capacity, and ability to mobilize capital.

- Branch Licensing

UCBs:

Automatic Route: Financially Sound and Well Managed (FSWM) UCBs can open 1-5 new branches, limited to 10% of their existing branches.

Approval Route: FSWM UCBs must submit an Annual Business Plan (ABP) to RBI for approval by December 15.

StCBs & DCCBs:

Require NABARD & RBI approval.

Conditions: CRAR ≥ 9%, NNPA ≤ 5%, no CRR/SLR default, good compliance record.

DCCBs need three years of operation, net profit in last two years, and no RBI restrictions.

- Governance Framework

Governed by respective State/Central Cooperative Society Laws.

Banking Regulation Act, 1949 (BR Act) provisions applied since 2020.

Key RBI governance requirements:

Formation of an Audit Committee of the Board.

Eligibility criteria for directors, MD/CEO/WTD, tenure limits, and provisions for Board supersession.

Large UCBs must appoint an independent Chief Risk Officer (CRO).

NABARD issues governance guidelines for rural cooperatives.

- Credit Risk Regulations

Urban Cooperative Banks:

Maximum exposure to shares, bonds, and debentures: ₹10 lakh (in dematerialized form).

Loan-to-Value (LTV) ratio: 50%.

Rural Cooperative Banks:

Maximum exposure: ₹5 lakh.

LTV ratio: 50%.

Securitization of Standard Assets:

Permitted: SCBs, AIFIs, NBFCs, HFCs.

Not Permitted: RRBs and Cooperative Banks.

SFBs follow their operating guidelines.

- Interest Rate Framework for SCBs & Cooperative Banks

Uniformity:

Interest rates must be consistent across all branches and customers.

No discrimination between deposits of the same amount on the same date at different branches.

Transparency:

Rates must be disclosed in advance.

Interest rates on NRE/NRO deposits cannot exceed comparable domestic term deposits.

- Mergers & Amalgamations

Governed by the BR Act, 1949.

RBI Approval Required under Section 44A for voluntary banking company mergers.

For UCBs (March 23, 2021 guidelines):

Amalgamations considered only if depositors’ funds are fully protected.

DCCB-StCB Amalgamations:

Governed by May 24, 2021 guidelines under Sections 44A & 56.

6) Answer: B

Short Explanation:

The Reserve Bank of India imposed a penalty of ₹66.60 lakh on HSBC and ₹33.10 lakh on IIFL Samasta Finance.

HSBC outsourced the disposal/closure of anti-money laundering (AML) alerts to a group company.

HSBC failed to report unhedged foreign currency exposures of certain borrowers to credit information companies (CICs).

HSBC opened savings deposit accounts for ineligible entities.

IIFL Samasta Finance charged interest on loans before actual disbursement or cheque issuance.

Detailed Explanation:

The Reserve Bank of India imposed a penalty of ₹66.60 lakh on HSBC and ₹33.10 lakh on IIFL Samasta Finance.

HSBC outsourced the disposal/closure of anti-money laundering (AML) alerts to a group company.

HSBC failed to report unhedged foreign currency exposures of certain borrowers to credit information companies (CICs).

HSBC opened savings deposit accounts for ineligible entities.

IIFL Samasta Finance charged interest on loans before actual disbursement or cheque issuance.

IIFL Samasta Finance failed to classify certain overdue accounts (90+ days) as NPAs.

Some NPA accounts were incorrectly classified as ‘standard assets’ without full arrears clearance.

Multiple customer identification codes were allotted instead of a Unique Customer Identification Code (UCIC) for individuals.

Violations were based on financial positions as of March 31, 2023.

RBI imposed these penalties as part of regulatory enforcement to ensure compliance with banking norms.

7) Answer: C

Short Explanation:

WhatsApp is working on integrating UPI Lite to enhance its payment system.

UPI Lite is designed for small, frequent transactions and reduces failures during peak hours.

Beta version (v2.25.5.17) testing suggests the feature is under development.

Unlike regular UPI, UPI Lite allows users to preload a small balance for faster transactions.

Detailed Explanation:

WhatsApp is working on integrating UPI Lite to enhance its payment system.

UPI Lite is designed for small, frequent transactions and reduces failures during peak hours.

Beta version (v2.25.5.17) testing suggests the feature is under development.

Unlike regular UPI, UPI Lite allows users to preload a small balance for faster transactions.

Key features of WhatsApp’s UPI Lite integration:

Limited to the primary device – Cannot be used on linked devices.

Pin-free payments – Allows quick transactions without authentication.

WhatsApp has over 500 million users in India, making it a potential competitor to Google Pay, PhonePe, and Paytm.

Currently, WhatsApp is not listed as a UPI Lite-supported app, but this integration could change that.

WhatsApp is also working on bill payments, enabling users to pay utility bills, recharge mobiles, and more within the app.

8) Answer: D

Short Explanation:

Rupee112, a Gurgaon-based fintech startup, has launched India’s first fully automated loan disbursal service via WhatsApp.

The service enables salaried professionals to access instant unsecured loans.

AI and ML streamline the lending process, eliminating paperwork and reducing approval times.

Borrowers can secure loans between ₹5,000 and ₹1,00,000 by messaging Rupee112’s official WhatsApp number.

Detailed Explanation:

Rupee112, a Gurgaon-based fintech startup, has launched India’s first fully automated loan disbursal service via WhatsApp.

The service enables salaried professionals to access instant unsecured loans.

AI and ML streamline the lending process, eliminating paperwork and reducing approval times.

Borrowers can secure loans between ₹5,000 and ₹1,00,000 by messaging Rupee112’s official WhatsApp number.

Real-time verification ensures fast loan disbursal directly into bank accounts within minutes.

The AI-driven model addresses challenges in traditional lending, improving security and efficiency.

WhatsApp integration enhances financial accessibility, leveraging a widely used platform in India.

9) Answer: D

ShorUPI transactions in January 2025 surpassed 16.99 billion, with a total transaction value exceeding Rs 23.48 lakh crore, marking the highest number recorded in any month, according to the Finance Ministry.

The total UPI transaction volume exceeded 131 billion, with a total value crossing Rs 200 lakh crore during the year.

Detailed Explanation:

UPI transactions in January 2025 surpassed 16.99 billion, with a total transaction value exceeding Rs 23.48 lakh crore, marking the highest number recorded in any month, according to the Finance Ministry.

The digital payments landscape in India has shown remarkable growth in the financial year 2023-24.

The total UPI transaction volume exceeded 131 billion, with a total value crossing Rs 200 lakh crore during the year.

Unified Payments Interface (UPI) continues to dominate India's digital payment ecosystem, contributing to 80% of retail payments across the country.

Its ease of use, extensive bank participation, and fintech adoption have made it the most preferred mode of real-time transactions.

10) Answer: B

Short Explanation:

The Reserve Bank of India (RBI) introduced a $10 billion dollar-rupee buy-sell swap on February 21, 2025, to inject rupee liquidity for a longer duration.

This follows a $5 billion swap conducted less than a month ago, reinforcing RBI's strategy to address liquidity needs.

Detailed Explanation:

The Reserve Bank of India (RBI) introduced a $10 billion dollar-rupee buy-sell swap on February 21, 2025, to inject rupee liquidity for a longer duration.

This follows a $5 billion swap conducted less than a month ago, reinforcing RBI's strategy to address liquidity needs.

The swap aims to stabilize the rupee's value while increasing India's foreign exchange reserves.

RBI has been selling dollars to manage rupee volatility, reducing rupee liquidity in the system.

As of December 31, 2024, RBI’s net forward dollar sales stood at $67.93 billion.

In Q3 FY24, RBI sold $45 billion in the spot market, including $15.15 billion in December, $20.22 billion in November, and $9.27 billion in October.

11) Answer: B

Short Explanation:

The Central Sector Scheme for Formation and Promotion of 10,000 Farmer Producer Organizations (FPOs) was launched by Prime Minister Narendra Modi on February 29, 2020, with a budget of ₹6,865 crore till 2027-28.

Recently, the 10,000th FPO was launched in Khagaria, Bihar, focusing on maize, banana, and paddy. So far, 30 lakh farmers have been linked to FPOs, with 40% participation from women, significantly boosting the agricultural economy.

Detailed Explanation:

The Central Sector Scheme for Formation and Promotion of 10,000 Farmer Producer Organizations (FPOs) was launched by Prime Minister Narendra Modi on February 29, 2020, with a budget of ₹6,865 crore till 2027-28.

The initiative aims to empower small and marginal farmers by improving market access, financial aid, and collective bargaining power.

Recently, the 10,000th FPO was launched in Khagaria, Bihar, focusing on maize, banana, and paddy. So far, 30 lakh farmers have been linked to FPOs, with 40% participation from women, significantly boosting the agricultural economy.

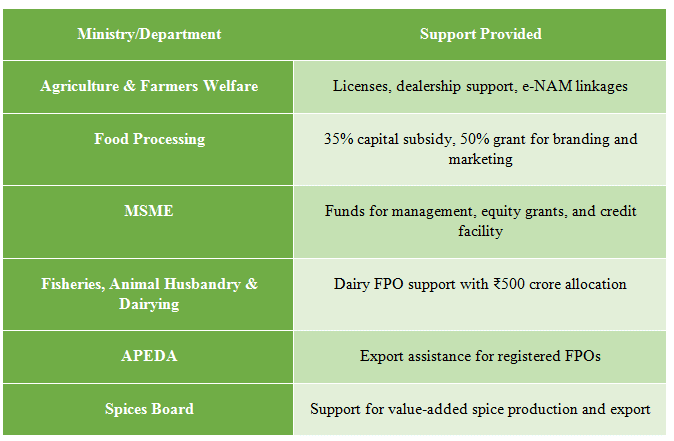

Government Support & Ministry Convergence

12) Answer: C

Short Explanation:

The Union government is considering a reduction in the share of central tax revenues allocated to states, lowering it from the current 41% to at least 40%.

This recommendation will be submitted to the Finance Commission of India, chaired by economist Arvind Panagariya, which is expected to present its report by October 31, 2025, for implementation from fiscal year 2026-27.

Detailed Explanation:

The Union government is considering a reduction in the share of central tax revenues allocated to states, lowering it from the current 41% to at least 40%.

This recommendation will be submitted to the Finance Commission of India, chaired by economist Arvind Panagariya, which is expected to present its report by October 31, 2025, for implementation from fiscal year 2026-27.

Additionally, the Centre is exploring restrictions on revenue-deficit grants to curb freebies and debt waivers by state governments.

The Centre will propose reducing states’ tax share from 41% to at least 40%.

The proposal is expected to be approved by the Union Cabinet by March 2025 before being sent to the Finance Commission.

A 1% reduction in states’ share could provide the Centre with an additional ₹350 billion ($4.03 billion) in revenue.

13) Answer: B

Short Explanation:

The Indira Gandhi National Centre for the Arts (IGNCA), under the Ministry of Culture, in collaboration with the Satyarthi Movement for Global Compassion, organized a literary discussion on Diyaslai, the autobiography of Nobel Peace Prize laureate Kailash Satyarthi.

Detailed Explanation:

The Indira Gandhi National Centre for the Arts (IGNCA), under the Ministry of Culture, in collaboration with the Satyarthi Movement for Global Compassion, organized a literary discussion on Diyaslai, the autobiography of Nobel Peace Prize laureate Kailash Satyarthi.

The event focused on the book’s exploration of social justice, child rights, and global compassion.

Diyaslai is the autobiography of Kailash Satyarthi, a renowned child rights activist and Nobel Peace Prize winner (2014).

Diyaslai not only recounts Satyarthi’s fight for children’s freedom and education but also sheds light on:

14) Answer: B

Short Explanation:

The Indian government has granted approximately USD 1 million to Lao People's Democratic Republic (Lao PDR) under the India-UN Development Partnership Fund.

The grant supports the project ‘Strengthening Large-scale Food Fortification: The Case of Investing in Rice Fortification’.

Detailed Explanation:

The Indian government has granted approximately USD 1 million to Lao People's Democratic Republic (Lao PDR) under the India-UN Development Partnership Fund.

The grant supports the project ‘Strengthening Large-scale Food Fortification: The Case of Investing in Rice Fortification’.

The initiative focuses on fortifying rice to combat micronutrient deficiencies and enhance long-term nutrition strategies.

The project aims to bolster food systems and improve the nutritional diversity of the country's food supply.

It seeks to address malnutrition by fortifying a widely consumed staple food in Lao PDR.

The Permanent Mission of India to the UN highlighted this as part of India's diplomatic and developmental cooperation with Lao PDR.

15) Answer: E

Short Explanation:

The Central Board of Trustees (CBT) of the Employees’ Provident Fund Organisation (EPFO), in its meeting held, recommended that the current annual interest rate of 8.25% on provident fund deposits be retained for the financial year 2024-25.

Detailed Explanation:

The Central Board of Trustees (CBT) of the Employees’ Provident Fund Organisation (EPFO), in its meeting held, recommended that the current annual interest rate of 8.25% on provident fund deposits be retained for the financial year 2024-25.

Despite trade union demands for a higher rate, the government decided to maintain the existing rate due to economic considerations.

Union Labour Minister Mansukh Mandaviya chaired the meeting, where the proposal to increase the interest rate was raised by trade union representatives.

The government chose to maintain the existing 8.25% rate, citing it as a stable and competitive return compared to other fixed-income investments.

Once the Government of India officially notifies the rate, EPFO will credit the interest into subscribers’ accounts.

16) Answer: E

Short Explanation:

The Index of Eight Core Industries (ICI) is a key economic indicator that tracks the performance of eight fundamental sectors of the Indian economy. These industries significantly influence the Index of Industrial Production (IIP), making their growth an important marker of economic health.

The ICI covers eight key industries, which together hold a 40.27% weightage in the overall Index of Industrial Production (IIP).

Detailed Explanation:

The Index of Eight Core Industries (ICI) is a key economic indicator that tracks the performance of eight fundamental sectors of the Indian economy. These industries significantly influence the Index of Industrial Production (IIP), making their growth an important marker of economic health.

The latest ICI report for January 2025 highlights trends in these core sectors and their impact on industrial and economic growth.

The ICI covers eight key industries, which together hold a 40.27% weightage in the overall Index of Industrial Production (IIP):

Coal

Crude Oil

Natural Gas

Refinery Products (such as petroleum and diesel)

Fertilizers

Steel

Cement

Electricity

17) Answer: D

Short Explanation:

An India-European Union (EU) —An India-European Union (EU) Meeting on Science and technology of the Principal Scientific Adviser to the Government of India, Vigyan Bhawan Annexe.

The meeting was part of a series of sectoral engagements coinciding with the visit of H.E. Ms. Ursula von der Leyen, President of the European Commission, to India, accompanied by the College of Commissioners.

Detailed Explanation:

An India-European Union (EU) —An India-European Union (EU) Meeting on Science and technology of the Principal Scientific Adviser to the Government of India, Vigyan Bhawan Annexe.

The meeting was part of a series of sectoral engagements coinciding with the visit of H.E. Ms. Ursula von der Leyen, President of the European Commission, to India, accompanied by the College of Commissioners.

Prof. Ajay Kumar Sood, Principal Scientific Adviser to the Government of India, and Ms. Ekaterina Zaharieva, EU Commissioner for Startups, Research, and Innovation, co-chaired the meeting.

India’s rapidly expanding innovation ecosystem—ranking third globally in startup and unicorn creation—was acknowledged as a key driver of collaboration.

The discussion highlighted India’s leadership in renewable energy, AI, and biopharmaceuticals, reinforcing the country's position as a global research and technology hub.

18) Answer: C

Short Explanation:

Ron Draper, a top-order batsman and occasional wicketkeeper, played two Test matches for South Africa against Australia in 1950.

Detailed Explanation:

Ron Draper, a top-order batsman and occasional wicketkeeper, played two Test matches for South Africa against Australia in 1950.

Born on December 24, 1926, he made a century on his first-class debut for Eastern Province against Orange Free State on his 19th birthday.

Draper played first-class cricket until 1959/60, finishing with a batting average of 41.64.

With Draper’s passing, Neil Harvey (96), a former Australian cricketer, becomes the oldest living Test player.

19) Answer: B

Short Explanation:

World Seagrass Day is observed annually on March 1 to highlight the ecological importance of seagrass and promote conservation efforts.

Seagrass plays a crucial role in maintaining marine biodiversity, stabilizing coastlines, and acting as a major carbon sink.

The United Nations General Assembly (UNGA) officially declared this day on May 22, 2022, following a resolution proposed by Sri Lanka to emphasize the urgent need for seagrass conservation.

Detailed Explanation:

World Seagrass Day is observed annually on March 1 to highlight the ecological importance of seagrass and promote conservation efforts.

Seagrass plays a crucial role in maintaining marine biodiversity, stabilizing coastlines, and acting as a major carbon sink.

The United Nations General Assembly (UNGA) officially declared this day on May 22, 2022, following a resolution proposed by Sri Lanka to emphasize the urgent need for seagrass conservation.

Seagrass is a flowering marine plant that thrives in shallow coastal waters worldwide, except in Antarctica. Unlike seaweed, which is an algae, seagrass has roots, stems, and leaves, making it similar to terrestrial plants.

20) Answer: E

Solution:

World Hearing Day is announced to be celebrated on March 3rd, 2025.

This year 2025, World Hearing Day theme is “Changing mindsets: Empower yourself to make ear and hearing care a reality for all!”

World Wildlife Day 2025 is celebrated on March 3rd, 2025.

World Wildlife Day 2025 theme is “Wildlife Conservation Finance: Investing in People and Planet”.

Daily Current Affairs Quiz - 05th March 2026

Mar 05 2026

Daily Current Affairs 05th March 2026 | Latest News | Download Free PDF

Mar 05 2026

Daily Current Affairs Quiz - 04th March 2026

Mar 04 2026

Most Liked

General Awareness Smart Analysis (Smart Quiz 2.0)

- Get Weekly 4 set Test

- Each Set consist of 50 Questions

- Compare your progress with Test 1 & 2 & Test 3 & 4

- Deep Analysis in topic wise questions

Super Plan

- All Banking PDF Course 2026, 2025, 2024

- All Banking Video Course

- All Banking Mock Test Series

- All Banking Bundle PDF Courses

- All Banking Ebooks

- All Banking Interview Courses Not Included

Premium PDF Course

- Bundle PDF Course 2025

- Premium PDF Course 2024

- Prime PDF Course 2023